The subject of Chinese cars comes up frequently among auto writers. Like the broader population, we’re pretty divided on the issue. From concerns about national security to the potential for a preponderance of cheap, fly-by-night builders who end up leaving nothing behind but a legacy of e-waste, there are any number of nits one might pick. For now, they’re being kept at bay primarily by a patchwork of national security and trade provisions that make it logistically difficult and/or prohibitively expensive to sell inexpensive Chinese cars in the United States. Until recently, the majority of car shoppers have been just fine with that, but now, the data nerds are telling us we may have hit an inflection point.

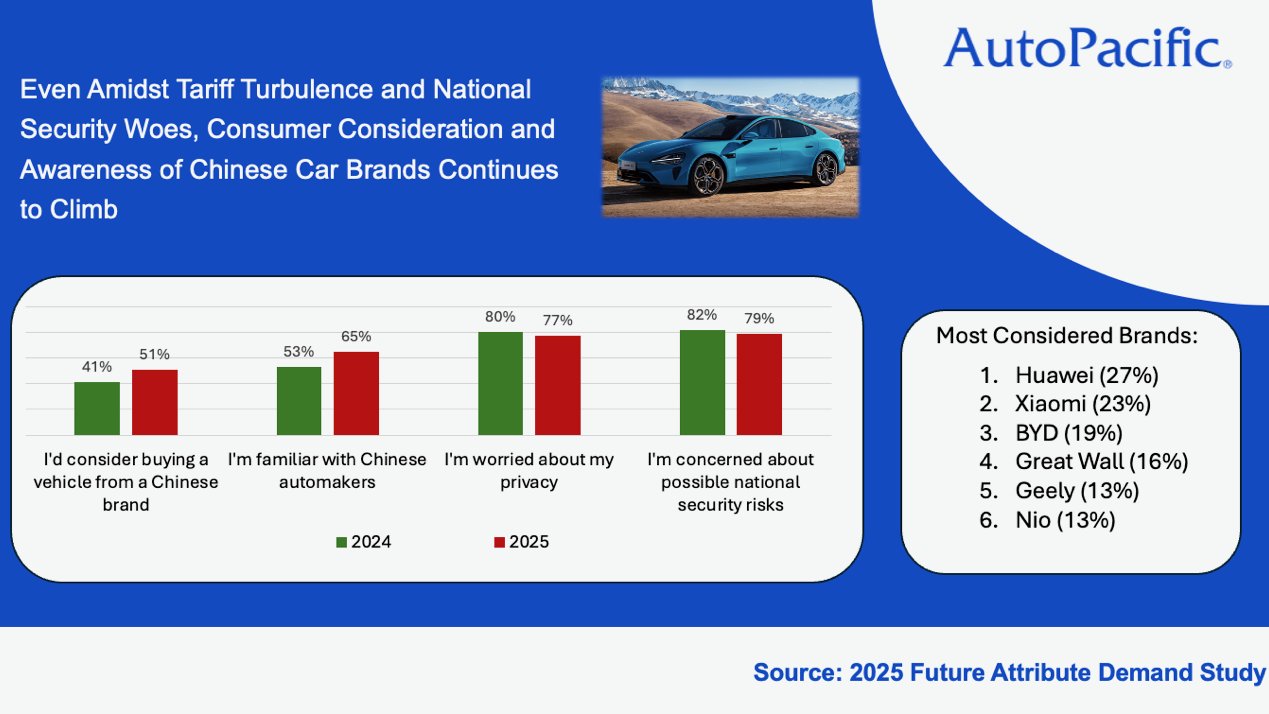

Just last year, AutoPacific’s annual Future Attribute Demand survey found that only about 40% of Americans were even open to the idea of buying a Chinese car. This year, after a survey of nearly 19,000 potential shoppers, that figure jumped to 51%. And in worse news for those who would rather not see Chinese cars sold in the United States, shoppers are not only open to the idea, but more aware of the brands and model ranges being sold overseas than ever before, with Huawei and Xiaomi capitalizing on their recognition from other segments. Why the sudden change?

“I think it’s two main reasons, and they coincide with each other,” explained Robby DeGraff, AutoPacific’s manager of product and consumer insights, to me.

“First, I feel as if consumers are becoming more and more enticed and intrigued by the uniqueness of various Chinese vehicles, whether NEV (EV/PHEV/EREV) or not,” DeGraff said. “Many of these vehicles not only possess perhaps ‘radical’ and ‘fresh’ styling and design inside and out, that isn’t really replicated here by players in our market, but also the abundance of unique and innovative features/technologies found on these vehicles.”

After all, while it was Tesla who first applied for a patent on EV battery swapping, it’s China where off-the-wall ideas like that are actually being tried out. Admittedly, not all of them have been winners, but pretending that these cars don’t offer value simply because they’re not sold here is a dangerous move from a competitive standpoint.

“While our stateside market still seems kinda of shy when it comes to making noteworthy advances in EV/EREV/PHEV powertrain development and accommodating infrastructure,” DeGraff said, “Chinese automakers seem to be pushing ahead at full speed.”

And then, of course, there’s the cost factor.

“With last week’s numbers showing the average price of a car hovering at $50,000,” DeGraff said, “I think any vehicle that can successfully package all of this aforementioned unique styling, design, features and tech, advanced powertrains, etc., at pricing that’s almost unfathomable and out of reach here, is definitely brewing more interest and consideration amongst U.S. consumers.”

“People, I think, are just eager for really fresh, hip, tech-forward products from automakers (Chinese) that aren’t afraid to take big risks and seriously think outside of the box.”

Their two biggest blockers—concerns about privacy and national security—remain prominent, dropping only single-digit percentages compared to last year.

“Second, and it’s just a brief [point] coinciding with the first one above…but more and more media (within the automotive media space and outside it) are covering Chinese vehicles,” DeGraff said. “So there’s greater awareness, buzz, and excitement for them as a result of the above differentiators that aren’t found on our market’s new vehicles.”

Blame TikTok if you must, but there’s more going on here than just subtle marketing pressure. American auto executives have largely resigned themselves to the fact that Chinese cars will come here eventually. Several CEOs of American businesses have even praised some of China’s cars, calling them superior in some key ways to those being produced elsewhere in the world—including right here at home.

Rivian’s RJ Scaringe rejects the notion that Chinese cars only have an advantage in cost: “The technology is much better,” he said. Meanwhile, Ford CEO Jim Farley has compared China’s automotive industry today to that of Japan and South Korea when both underwent similarly rapid expansion in previous decades.

What do you think? Are you open to driving a mainstream Chinese car? Either way, make yourself heard in the comments. The industry is watching.

Got a tip? Let us know at tips@thedrive.com!