Few things generate as much cringe as a corporate TikTok, but one Arizona dealership struck viral gold for all the wrong reasons. Employees at Larry H. Miller Chrysler Jeep Dodge Ram in Surprise, Arizona, sounded off on their absurdly large car payments, and the internet isn’t having it.

The dealership has since removed two of its videos where it asks employees to chime in with their car payments, but copies and stitches reacting to the videos are still out there. The premise is simple: It’s a roundup of how much dealership employees are paying per month for the vehicles they own, listing only the monthly payment and the car it’s for.

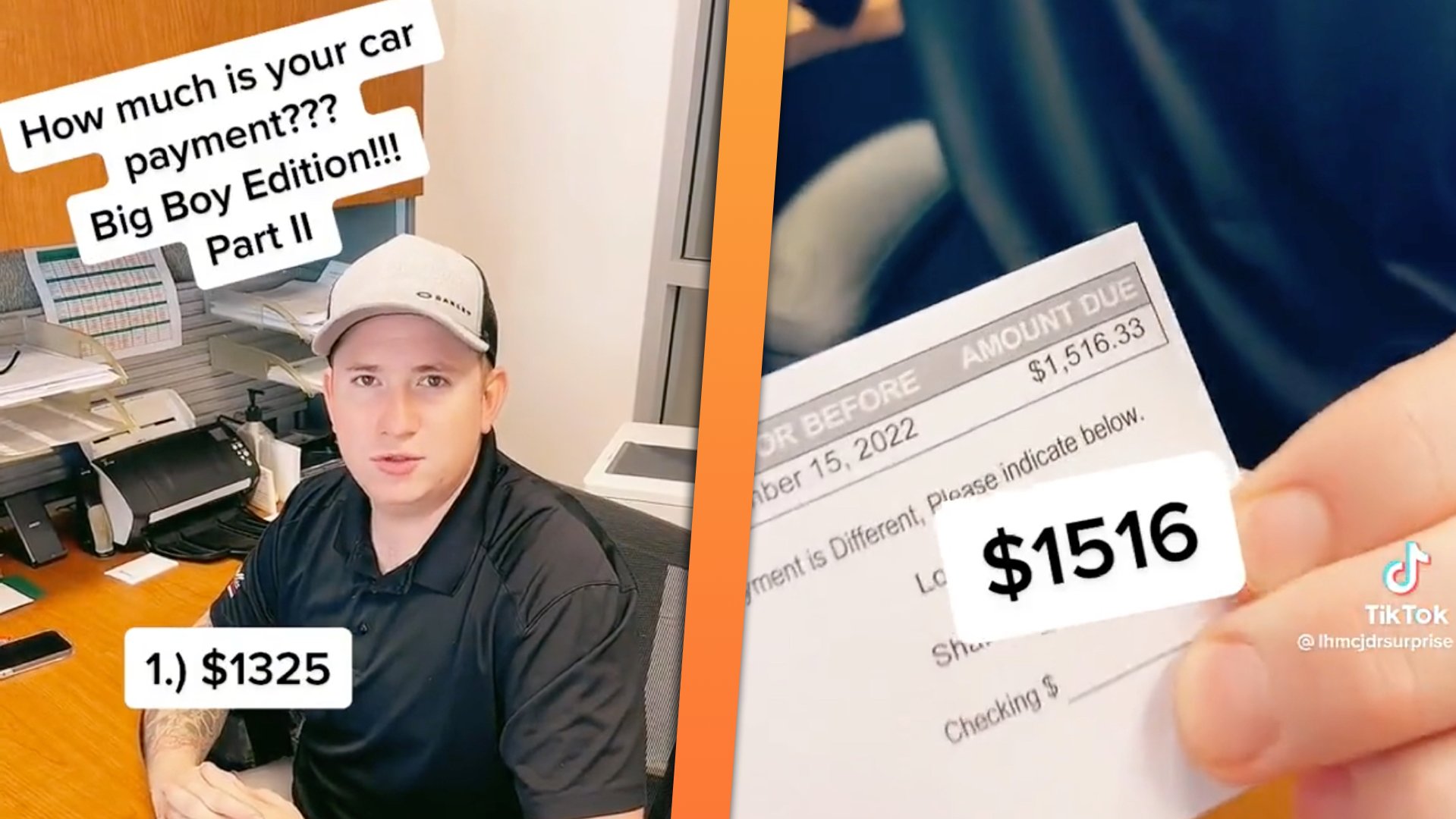

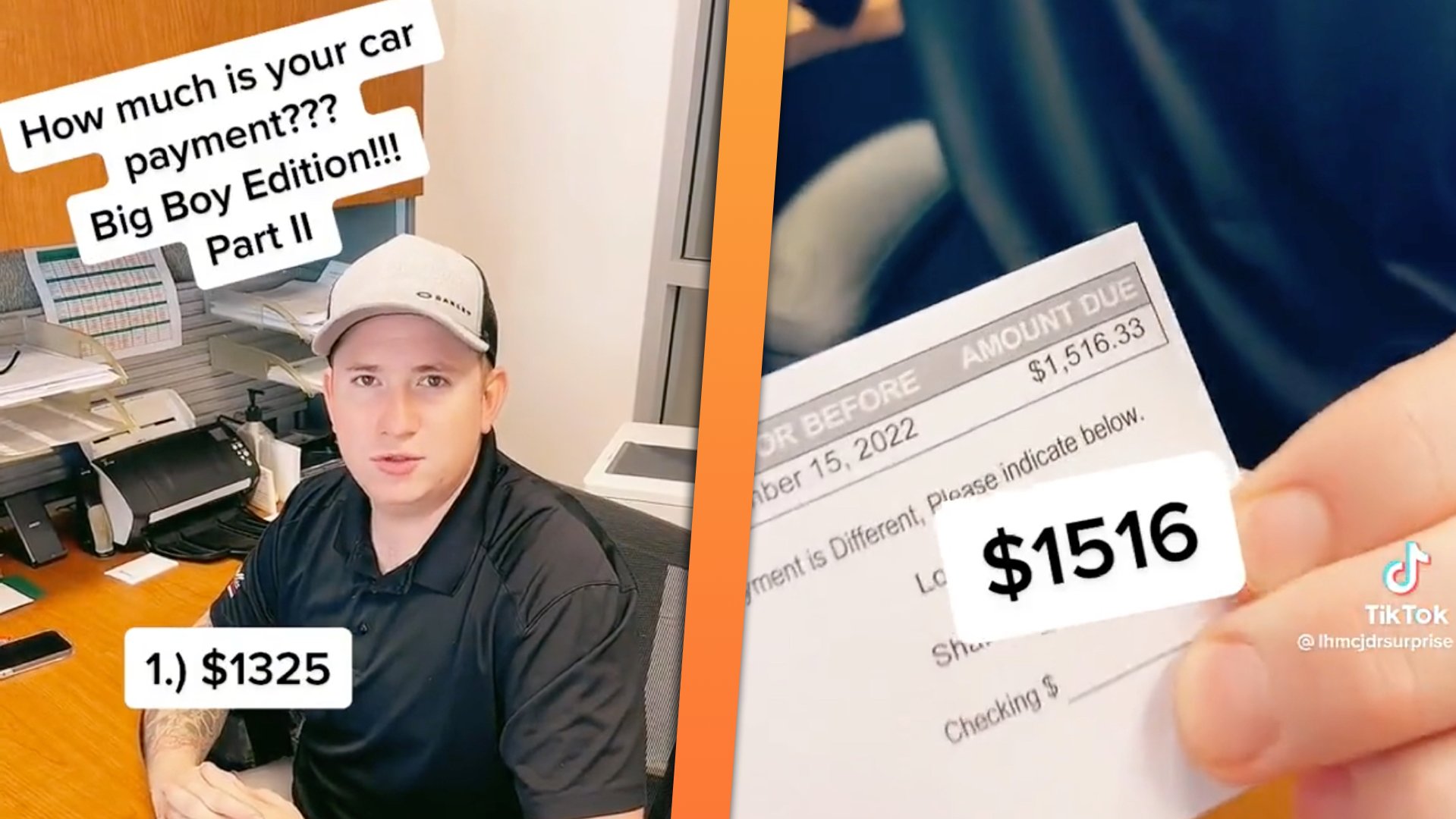

To be fair, the Miller dealership isn’t the only one to have done this, either. Other dealerships have everything from pretty normal-sounding payment roundups to more high-dollar cringe. Yet Miller’s Arizona dealership was the one that released a “Big Boy Edition!!!” (direct quote from the video text) of all four-figure payments, and that’s the one that’s gotten the most viral attention.

Reactions have been mostly negative, for understandable reasons. It’s tone-deaf to publicize your employees’ highest car payments at a time when average monthly car loan payments are skyrocketing in a way that feels straight out of 2008. The average monthly new car loan payment was $667 in the second quarter of this year, per Forbes, up from $582 in the second quarter of 2021. A record 12.7% of new vehicle loans made in June 2022 had four-figure monthly payments according to Edmunds, up from 7.3% in June 2021. Interest rates are up and 2022’s assortment of supply chain interruptions have pushed car prices up even further, and it’s squeezing everyone—especially subprime borrowers—into less favorable terms that ultimately force them to pay way too much over the life of the loan and that could set some borrowers up for default.

There’s an unsettling “we do it, too” factor to videos like this that acts to normalize gargantuan monthly payments, regardless of whether that was part of the dealership’s intent or not. (The Drive reached out to the dealership in the video for comment, and has not received a response at the time of this writing.) Miller’s video only lists the kind of car financed, not the terms of the loans or any relevant data on the borrowers, like salaries or credit scores. Dealership employees aren’t usually high rollers, though, and frankly, it should be shocking to hear them shell out this much on a single monthly car payment.

@lhmcjdrsurprise #jeep #wrangler #sales #arizona #rockyridge #4×4 #surpriseaz #trailrated #topoff #lifted #wheels #jeeplife #offroad #itsajeepthing #jeepfamily #adventure #rubicon #willys #jeepbeef #jeepnation ♬ original sound – BLAKE

A couple of theories as to why these payments are so high have stood out in the reactions to this video. J.D. Power VP of Data and Analytics Tyson Jominy suggested on Twitter that these employees intend to flip the cars in light of 2022’s bizarre automotive market, taking on higher payments in order to keep interest rates as low as possible. “All smart dealership employees are flipping cars every six months and making $5k doing so,” Jominy tweeted.

Another theory posted by TikTok user ben_bossed_up—who says he’s worked at other dealerships before—noted the extra pressure on sales staff to sell to themselves when sales numbers are down. It’s still a sale, so it still counts.

@lhmcjdrsurprise #saleshumor #funny #joke #viral #duet #tiktok #humor #sales #staff #buy #drive #mopar #credit #poorguy #dodge #lhmsurprise #fyp ♬ suono originale – carmelasancineto77

Yet pair this context-free foray into dealership employees’ car payments with a social feed that also advertises the dealership’s willingness to work with subprime credit scores, and it leaves you with the worst taste in your mouth. TikToks referring to paying $800 a month for a Jeep as if it’s no big deal “hit differently” in that context, as The Teens ™ might say. Borrowing to buy a new car isn’t inherently bad, but the hyper-focus on monthly payments and normalization of paying more for a car than many mortgages out there isn’t good for anyone.

All of this is to say, please stick to regular cringe on the company TikTok. Your “fellow kids” will thank you when they don’t fall for loans they can’t afford.

Got a tip? Contact the author: stef@thedrive.com