The pricing issues about to hit the marketplace for auto parts are nothing new for suppliers. Somebody with deep direct insight on this, Premium Guard Inc. (PGI) founder and CEO Anan Bishara, knew that continuing production in China wouldn’t be sustainable during President Trump’s first administration. Now Trump’s back in office, and the pain is about to hit the car owners.

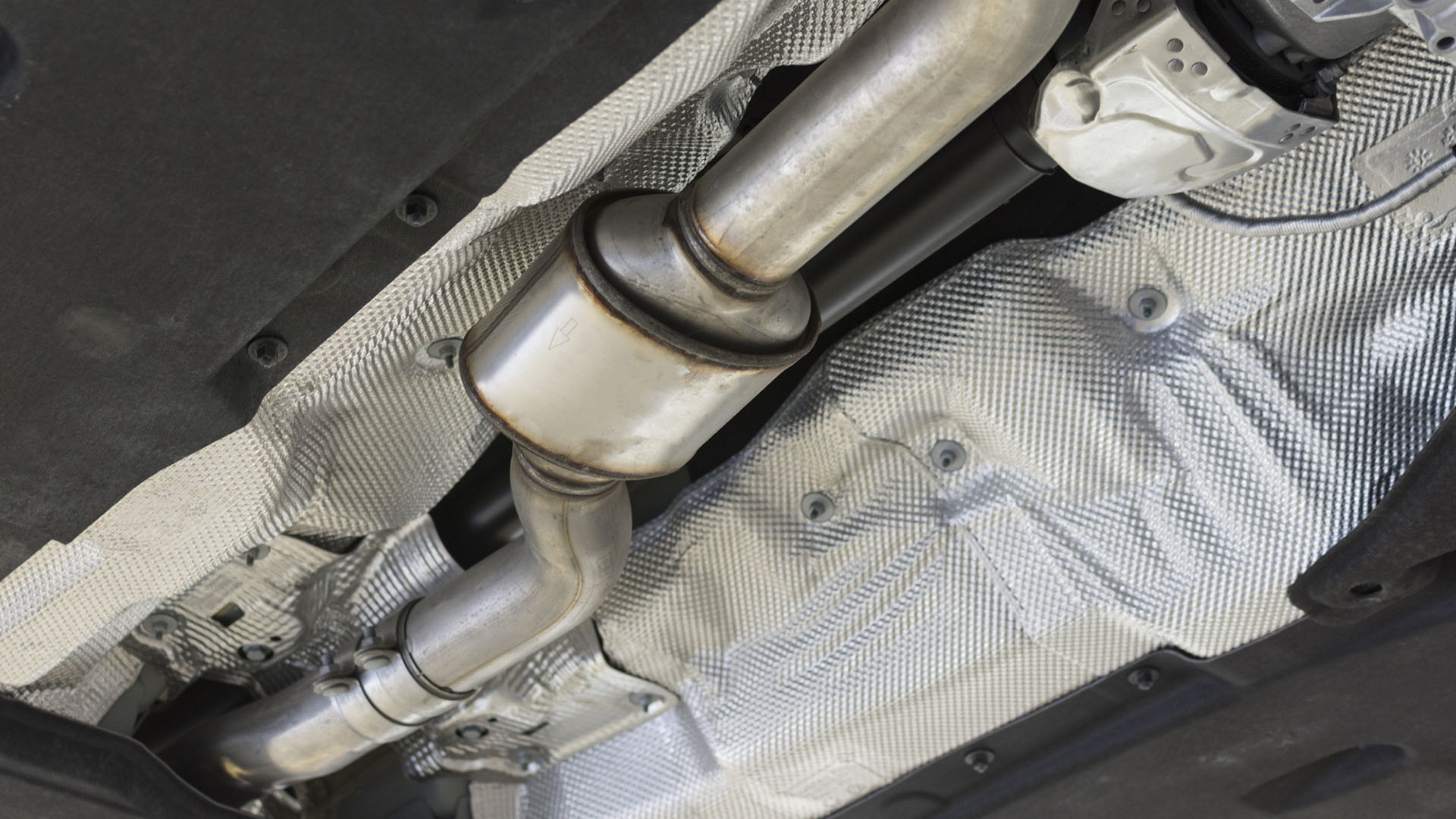

To date, Bishara told The Drive that consumers haven’t truly felt the ripple effects of tariffs on automotive parts—but that’s about to change just in time for the holidays. Catalytic converters that cost $1,200 or $1,500 are about to cost over $2,500 thanks to tariffs, according to the executive.

PGI is one of the larger automotive parts suppliers in North America. The company has over 30% of the market share on oil filters alone, according to Bishara. These parts are sold through retailers, fast lube centers, repair shops, and PGI’s entrenched in all segments, including brick and mortar, e-commerce, and service (though the vast majority of the products PGI sells are white labeled).

Particular categories, such as catalytic converters, which require rare-earth metals of which 92% of the world’s supply comes from China, are going to get hit hard with tariffs. That’s just today. Bishara said these types of items that require content from China could be subject to further regulation. Uncertainty is the biggest piece of all this, with Bishara always thinking, “What will tomorrow bring?”

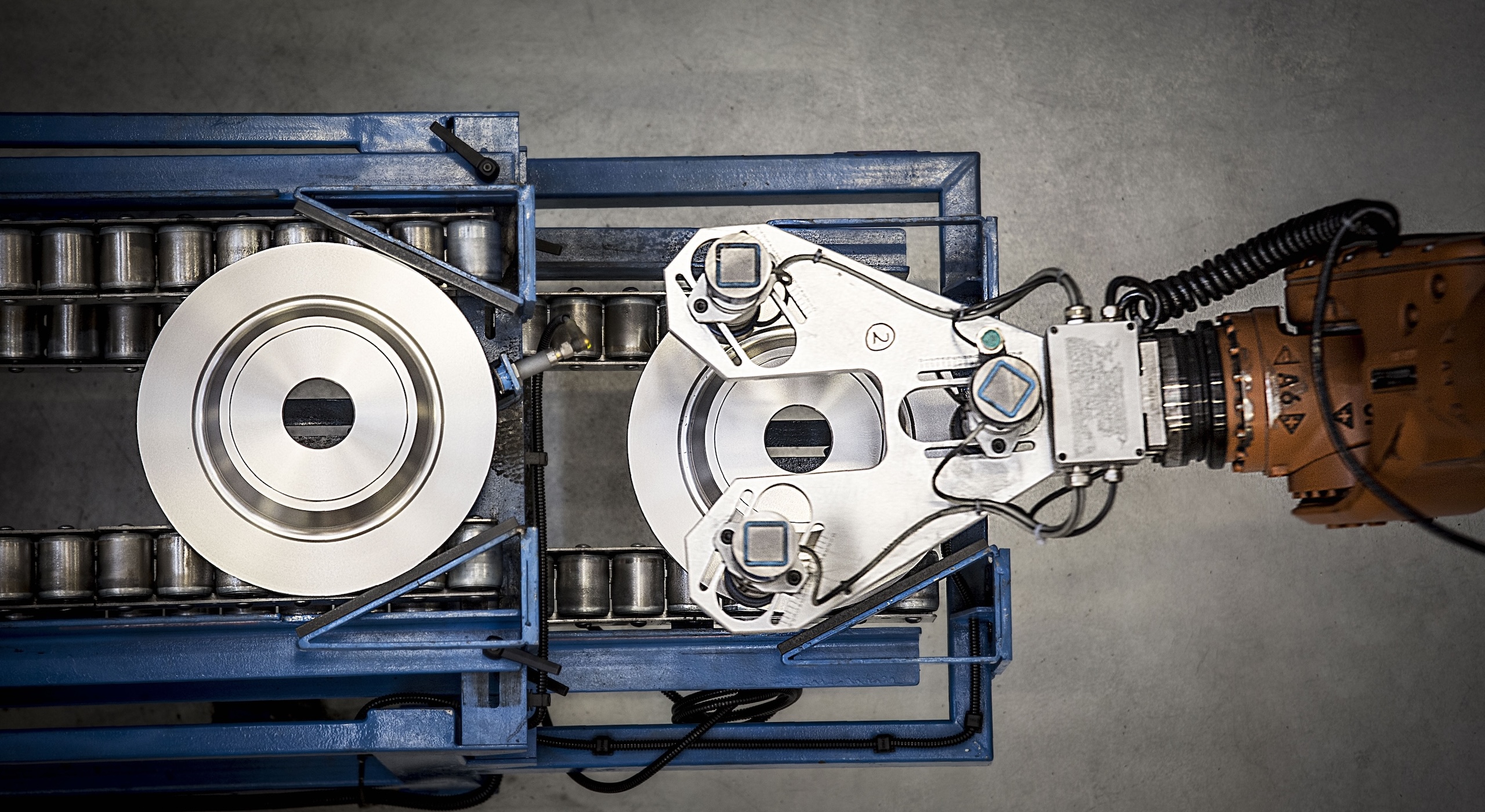

Simple everyday wear items like brake rotors, which are typically made from steel, are about to get significantly more expensive according to Bishara, and it’s all due to President Trump’s tariffs.

The issue is complex. There’s the question of what the material is, its origins, where the part is manufactured, and the path to get the part into the U.S. market.

Consumers haven’t felt the ripple effects yet because changing pricing isn’t a simple “flip the switch situation,” Bishara said. For consumer-facing sales, it takes a lot of work and effort behind the scenes to change pricing on the shelf at a retailer. To date, most resellers, and even some suppliers, have taken a “wait and see approach,” the exec noted. This was particularly true with the first period earlier in the year, in April and May, when tariffs were just being implemented.

In May, when it became clear to suppliers that some level of tariffs were sticking around, companies implemented some sort of price increase to cover their bases as a starting point. “In our case, it was just something in the scope of 4-5%, just to cover our basis and ensure that we wouldn’t be hit with major losses,” Bishara said. Other companies did different things, and it all varied by products and supply chains, the exec noted.

Bishara noted that PGI has a diversified supply chain with 50 different production lines manufacturing automotive parts in countries like Vietnam, Malaysia, Taiwan, Indian, and more, which puts it in a better position to shift production outside of China.

But shifting production outside of China isn’t as simple as picking up the phone. “If you look at other products, it’s not as simple for them.” There are capital investments with robotics and safety processes along with the ecosystem with steel production that, all combined, could cost $20-$30 million. “This is not an easy thing to move outside of China overnight.”

In PGI’s case, Bishara was able to move production out of China and absorb some of the early tariffs, but a minor price increase was indeed implemented early on as the team waited between April and August to see how things shook out.

August 1 brought new announcements and policies. “India was a big shock to us, we thought India had the infrastructure and had the capability and manpower to offer an alternative to China, just in terms of scale.” When you talk about scale you have to talk about the ecosystem, the exec noted. “Vietnam is a great country, so are other countries, but no other single country has the scale that China has. India offered that option.”

Bishara said he and the aftermarket industry were “surprised” that India was subject to 50% tariffs. “We understand the motives,” but the parts exec is focused on his business.

This all brought a second wave of price increases, and this one, across the aftermarket during August and September, is going to be felt across the board. “Those increases have not hit the market in my view yet.”

Certain categories are going to get hit especially hard. Bishara noted that hydraulic power steering pumps are a category that is not growing, but declining, with the adoption of electric power steering systems. “The capital investment is huge, so nobody will go and invest, you know, $30 million or $40 million for production outside of China,” Bishara said. In five years, Bishara expects this category to lose maybe 30% or even 40% of today’s business, which means it doesn’t make sense to put money into shifting production from China. “But still, there are close to about 180 million vehicles on the road today that need those hydraulic parts,” the exec noted. Those customers are going to be faced with parts that cost exponentially more money, whether it’s a dealer, an aftermarket shop, or just buying parts off the shelf at a local store.

The brake segment particularly, is going to “suffer tremendously,” Bishara predicts.

“If a car needs an oil change, maybe you hold back a few weeks, a month, but eventually you have to do it. Same thing goes for brakes. If you need to replace your set of brakes, there’s a limit to how much you can hold back.” Bishara said noting that consumers can only defer maintenance on wear items for so long.

Bishara noted PGI hasn’t seen a rush from consumers to buy parts. “Why would you go buy a set of brakes if you don’t need it,” the exec said.

His best advice to people? “Stocking up wouldn’t be a bad idea.”

Got a tip about tariffs impacting your automotive life? We want to hear from you at tips@thedrive.com