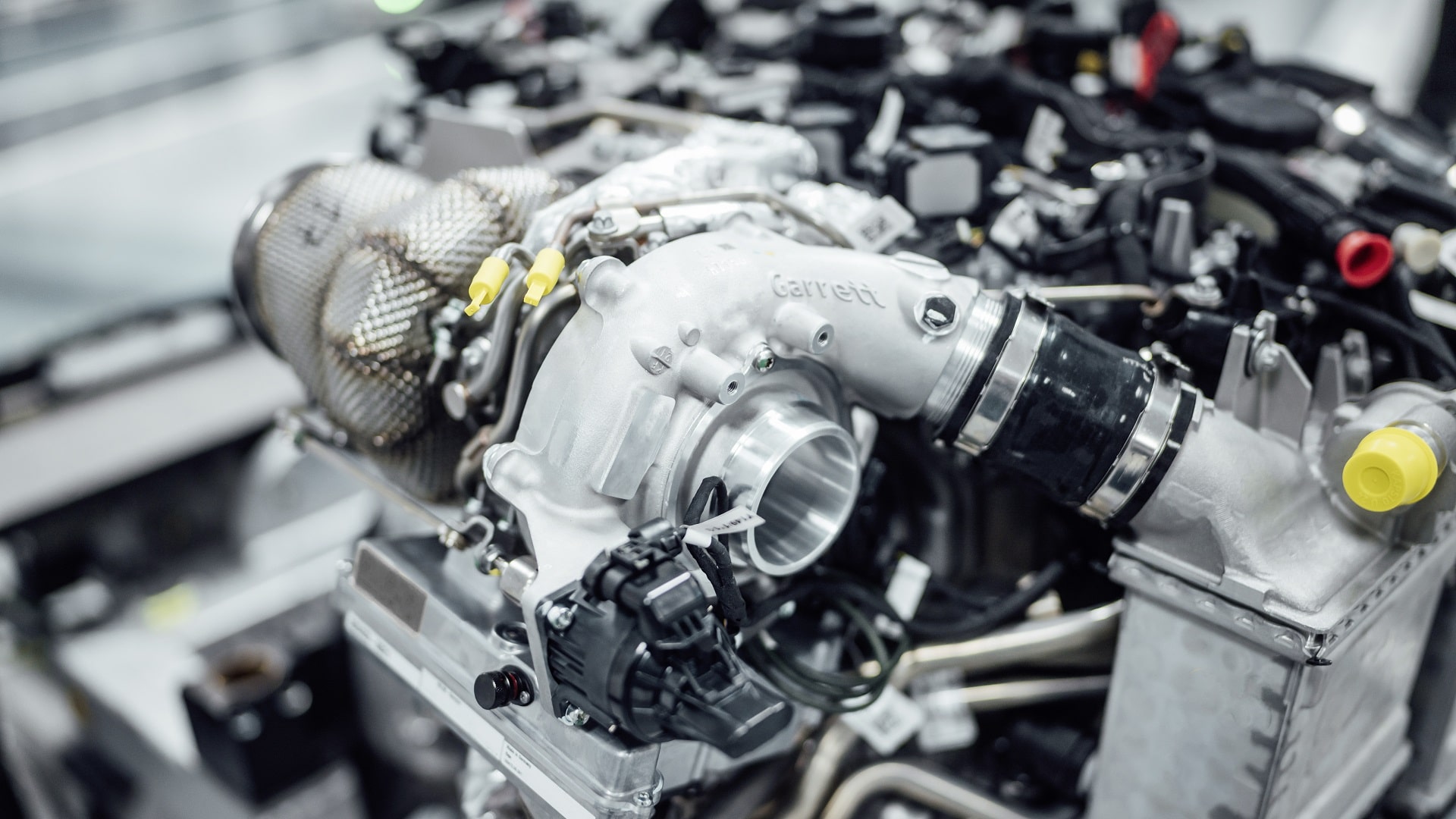

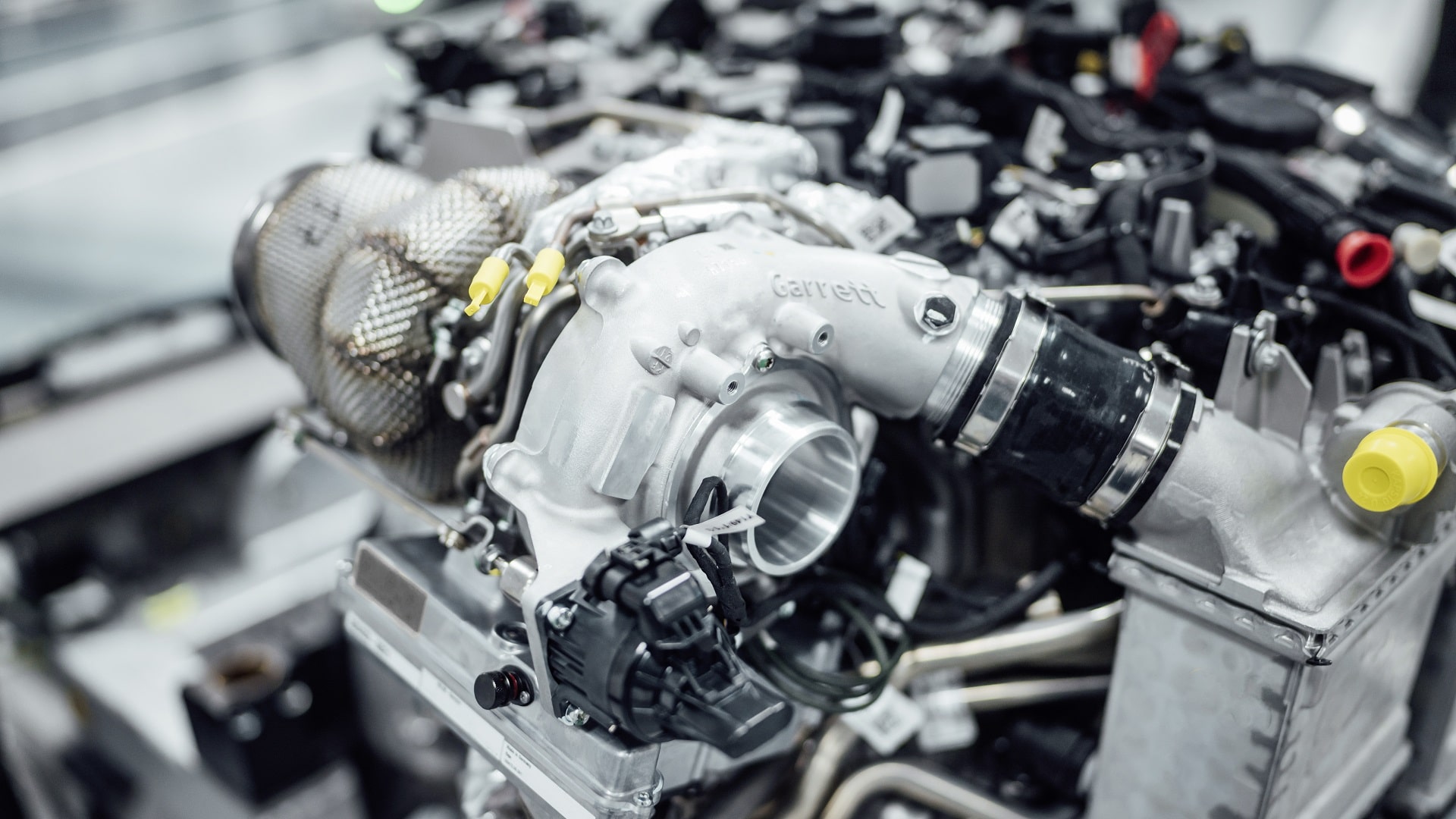

2020 has been an ugly year for the auto industry, and by extension, its vast supply chain. Tumbling car sales, in turn, mean reduced demand for brake pads, tires, and as Garrett Motion Incorporated has found, turbochargers. Indeed, the famed compressor manufacturer has filed for chapter 11 bankruptcy, citing a combination of plunging sales and financial burdens Honeywell International offloaded onto Garrett before the company’s spinoff.

Becoming independent from its longtime parent company in late 2018, Garrett departed with a 30-year indemnification agreement that left it liable for settling asbestos exposure claims against historic Honeywell brand Bendix. Garrett contended in December 2019 that this agreement was imposed on it by a planted Honeywell executive seeking to jettison financial liabilities, and Garrett has accordingly sued Honeywell to invalidate the agreement.

“Although the fundamentals of our business are strong and we have continued to try to develop our business strategy, the financial strains of the heavy debt load and liabilities we inherited in the spinoff from Honeywell—all exacerbated by COVID-19—have created a significant long-term burden on our business,” said Olivier Rabiller, president and CEO of the newly Switzerland-based firm, in a Yahoo! News story.

A Honeywell spokesperson disputed the Garrett executive’s statements, accusing the turbo manufacturer of using bankruptcy as a means to shirk its legal responsibility for Bendix’s asbestos liabilities.

“Garrett always has been capable of fulfilling those obligations with the assets it received in the spinoff,” the Honeywell spokesperson told The Wall Street Journal, alleging that Garrett’s bankruptcy filing is for the “single, improper purpose of avoiding the legitimate and reasonable financial commitments.”

Garrett’s chapter 11 bankruptcy filing does not mean the imminent end of Garrett-branded high-tech turbochargers; it’s merely an opportunity for the corporation to restructure itself under new ownership. The firm has already identified a potential new owner in investment group KPS Capital Partners, which Garrett hopes will pick it up for $2.1 billion.

Got a tip? Send us a note: tips@thedrive.com