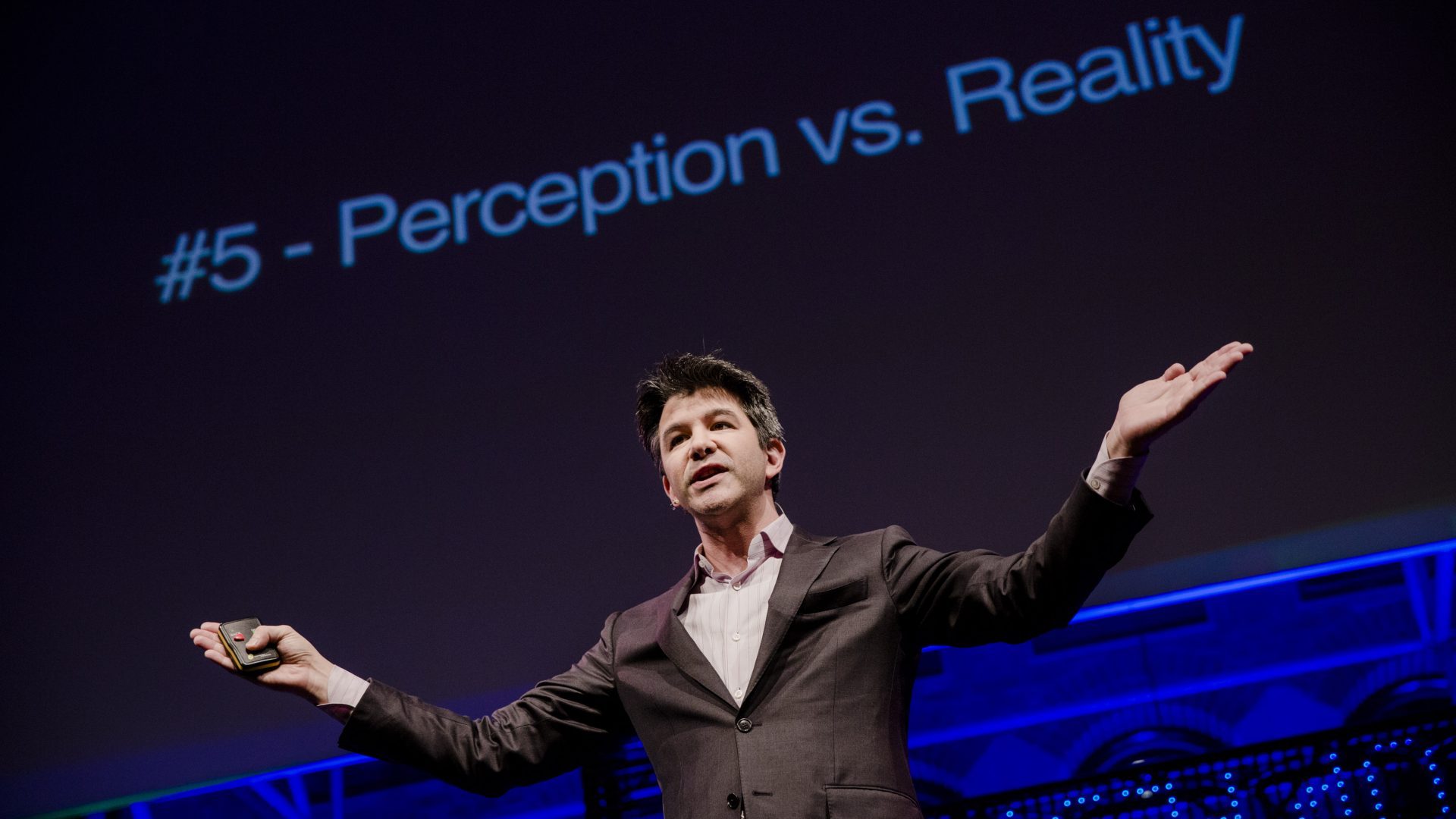

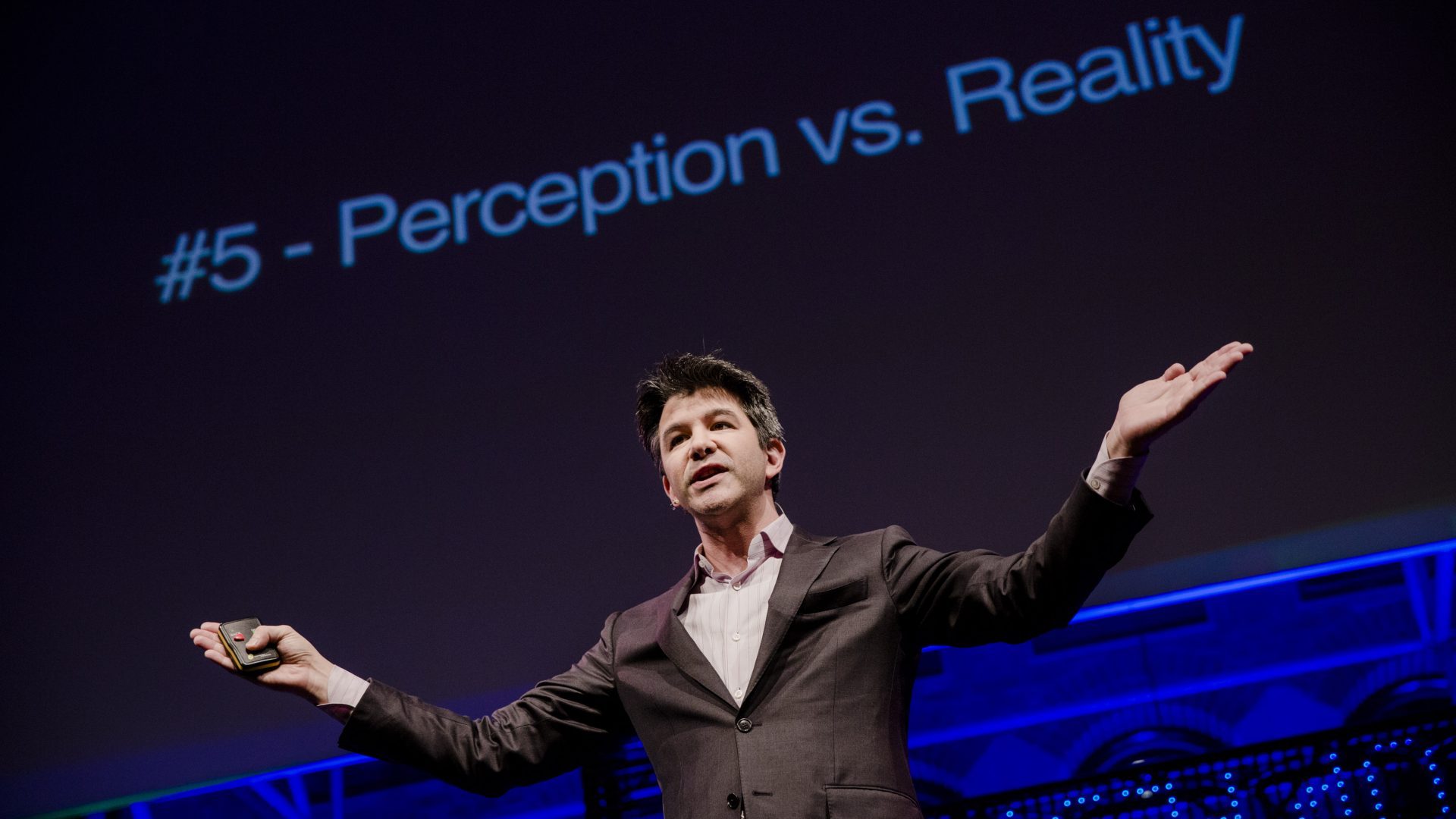

User’s board of directors voted Tuesday on governance changes that will limit the influence of ex-CEO Travis Kalanick, approved a major investment from Japan’s SoftBank, and set the goal of an initial public offering (IPO) by 2019. It’s an attempt by the board to end internal discord within Uber, which has been plagued by scandals all year.

A major change is the removal of extra voting privileges for certain types of Uber stock. Kalanick owns a third of so-called Class B common stock, which currently gives its owner 10 votes per share, according to Engadget. Under the new system, each share will count for one vote only.

The new rules also make it harder for Kalanick to engineer a return as CEO, or generally consolidate power. Both Kalanick and new Uber CEO Dara Khosrowshahi are barred from serving as chairman on board committees. Any new CEO will require two-thirds approval of the board.

Kalanick controls three seats on the board including his own, and moved last week to fill the other two. But on Tuesday, the board voted to expand the board from 11 members to 17, diluting Kalanick’s influence. The fear that Kalanick would stuff the board with lackeys and get himself back into the CEO chair led Uber investor Benchmark to file a lawsuit against Kalanick. Benchmark has agreed to drop the suit if the SoftBank deal closes, according to Business Insider.

If the SoftBank deal goes through, the Japanese firm will invest $1 billion to $1.25 billion in Uber. SoftBank hopes to acquire a 14 to 17 percent stake in Uber by buying stock from existing shareholders after that initial investment. Uber will then pursue an IPO in 2019. If it fails to do so, the company will lift restrictions on the selling of shares. That will give investors a way out if Uber goes in a direction they don’t like, potentially preventing a repeat of the Benchmark lawsuit. Because in order to deal with all of its external problems, Uber needs to end corporate infighting.