Here’s Why Intel Thinks Self-Driving Cars Will Be a $7 Trillion Business

Sharing services and smartphones will be the key, the tech company says.

Many companies in both the tech and automotive industries believe self-driving cars are an inevitability, and that they could be quite profitable. Now, Intel has actually put a dollar amount on that future. In a new report, it claims self-driving cars could be a $7 trillion business by 2050.

The report, produced by Strategy Analytics, assumes self-driving cars will appear in large numbers relatively soon, producing $800 billion in revenue for companies by 2035. It also claims societal and consumer benefits such as 585,000 lives saved by safer autonomous cars between 2035 and 2045, saving $234 million. Intel also predicts self-driving cars will free up 250 million hours of commuters' time.

All of this will be made possible by a shift to what Intel calls the "passenger economy." Like the much-discussed "sharing economy" that spawned services like Airbnb, the "passenger economy" is based around consumers choosing shared services over ownership—in this case, of cars. Like many previous analyses, the Intel report expects autonomous driving to boost ride sharing by making it more accessible and convenient.

Intel believes individual consumers using shared autonomous cars will account for the biggest slice of the $7 trillion autonomous-driving pie, generating $3.7 trillion in revenue by 2050. Commercial uses, such as self-driving delivery trucks, will account for $3 trillion, according to the report. Finally, "new emerging applications and services" in areas as varied as hospitality, tourism, and healthcare will account for $203 billion.

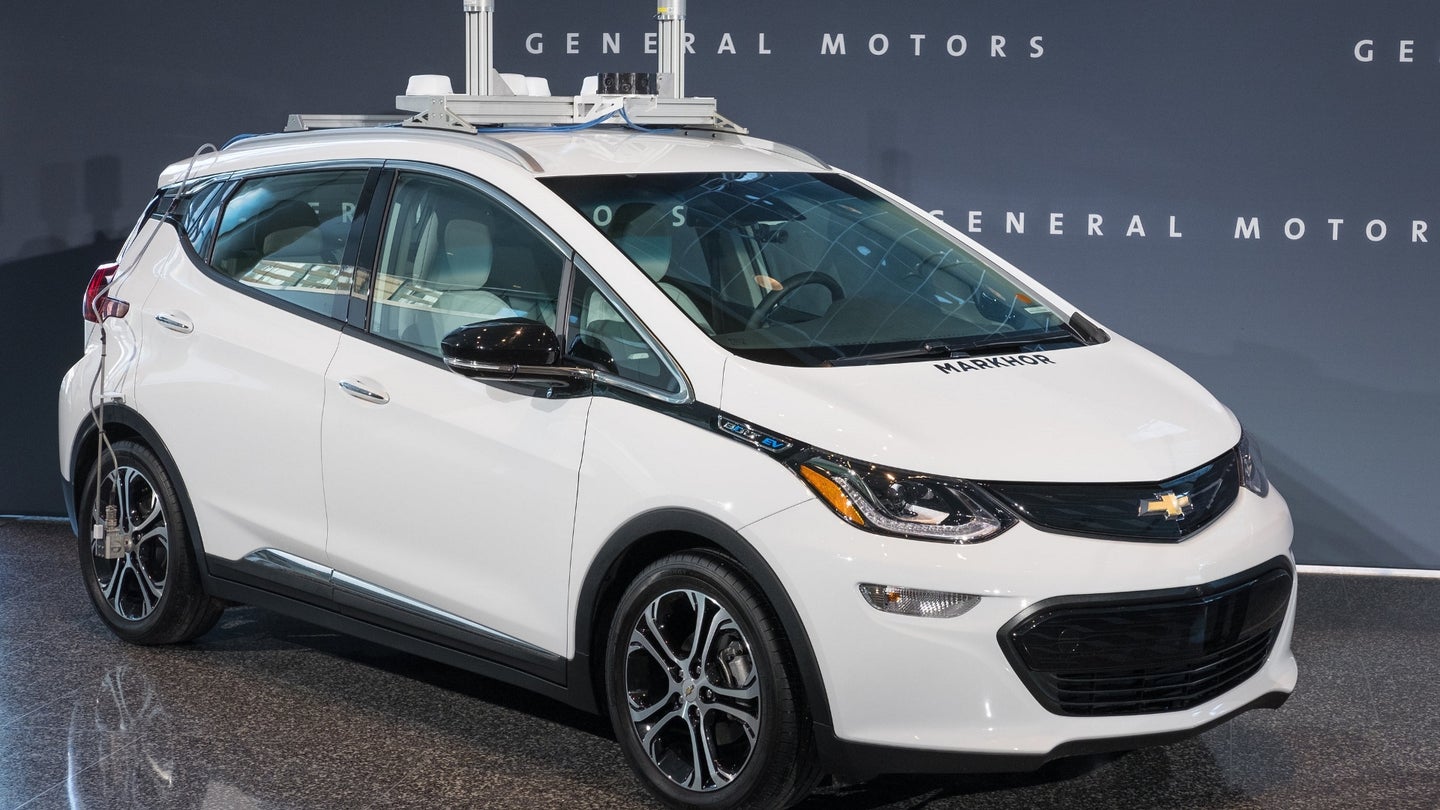

Intel isn't the first to say that autonomous ride sharing will be a gold mine. It's expected to reduce new-car purchases, but companies expect to make up for that by building self-driving cars and operating sharing services. Ford plans to launch a self-driving car in 2021 exclusively for ride sharing, General Motors has cozied up to Lyft with a similar goal in mind, and Tesla CEO Elon Musk has even said the company's planned autonomous ride-sharing service will be cheaper than public transportation.

Self-driving trucks have also gotten more attention lately. Uber bought autonomous-truck startup Otto last year, although Otto is now at the center of a legal dispute between Uber and Waymo. The latter is now investigating self-driving trucks as well. However, autonomous trucks haven't benefitted from nearly as much development work as autonomous cars, and may face stiffer opposition from labor. A recent Goldman Sachs study found that autonomous vehicles could cut 300,000 professional driving jobs in the U.S. per year.

The report does address job losses to some extent, noting that "automation technology will inevitably replace some jobs resulting in operational efficiencies." It also notes that the relatively low level of education requirements for human drivers may make transitioning to other jobs difficult. But the Intel study also claims the amount of time required for a full transition to automated vehicles will allow the labor force to adapt, and that workers could be shifted to support jobs, like vehicle maintenance.

Considering how volatile a political issue job creation has become in the U.S., it's hard to imagine autonomous vehicles not proving controversial on that front. While companies may not feel responsible for workers left behind by automation, they will need approval from lawmakers to make autonomous vehicles legal. At least in the short term, those lawmakers might not be eager to approve said regulations if they believe this technology will cost jobs and render them unpopular with voters.

If ride-share cars and delivery trucks are the "how" of this autonomous future, then Intel believes the culture built up around smartphones is the "why." The report claims increased connectivity makes time spent in a car so valuable for work or socializing that it shouldn't be wasted driving. That, along with increased urban congestion and consumers' acceptance of ride-sharing services, creates a ready market for self-driving cars, according to Intel.

It's worth noting that Intel already has some skin in this game. The company plans to spend $250 million on autonomous-car development over the next few years, and recently bought Israeli tech firm Mobileye for $15 billion. Mobileye's cameras and image-recognition software are geared toward autonomous cars. Both Intel and Mobileye are working with BMW to test autonomous cars, ahead of the German automaker's planned 2021 launch of a production self-driving car.