SEC Files Charges Against Volkswagen, Former CEO Winterkorn For Dieselgate-Era Fraud

More than two years after the initial emissions-related charges were settled, regulators now say that VW also defrauded investors.

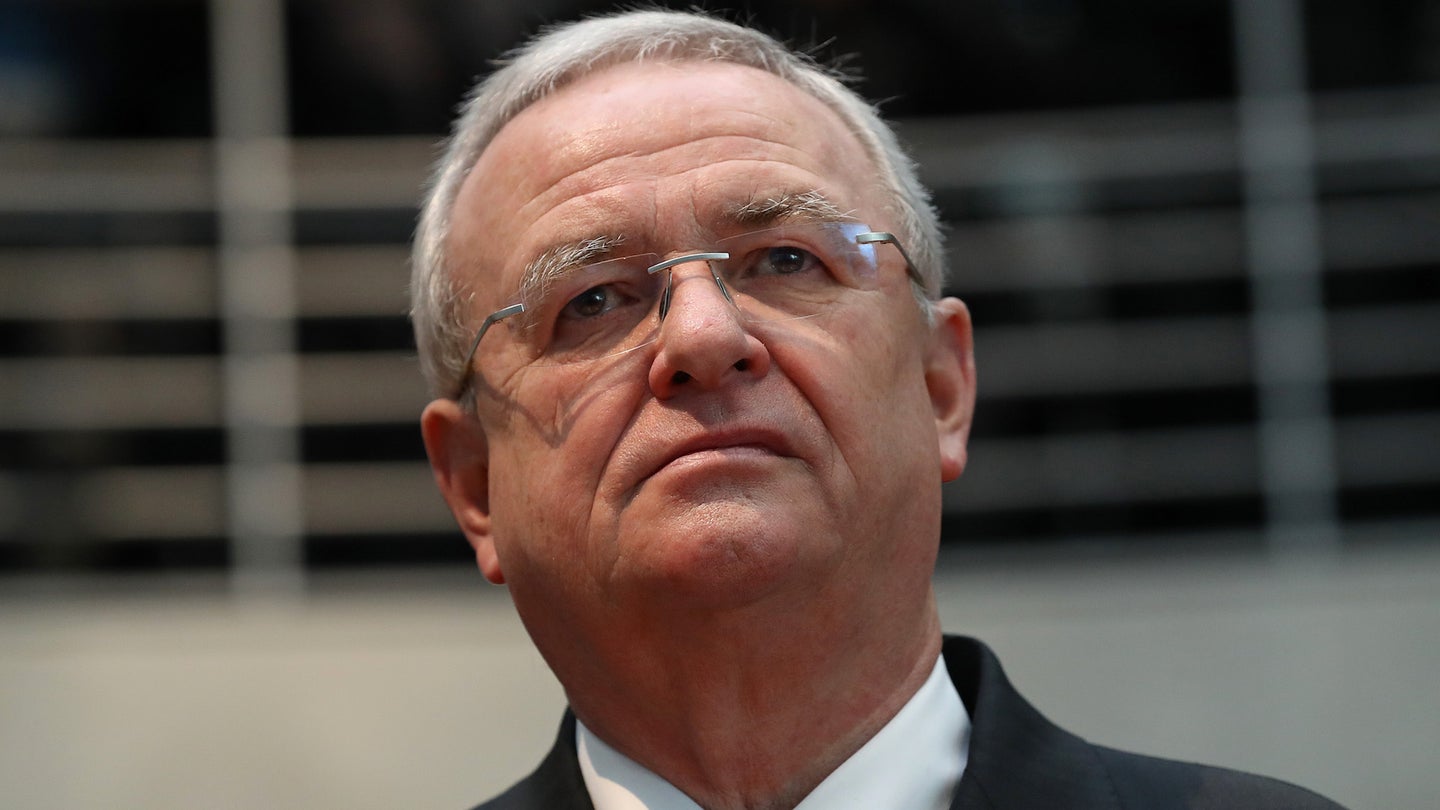

The United States Securities and Exchange Commission has filed charges against Volkswagen AG and its former CEO, Martin Winterkorn, for their respective involvements in the notorious dieselgate scandal unearthed in 2015.

Charges were announced on Friday, more than two years after Volkswagen settled with the U.S. government on criminal and civil charges surrounding intentionally botched emissions software. The new complaint alleges that Volkswagen made deceptive claims regarding its fleet of "clean diesel" vehicles in order to rake in billions of dollars in bonds from U.S. investors.

"Issuers availing themselves of American capital markets must provide investors with accurate and complete information," said Stephanie Avakian, Co-Director of the Division of Enforcement. "As we allege, Volkswagen hid its decade-long emissions scheme while it was selling billions of dollars of its bonds to investors at inflated prices."

Regulators eye the time period between April 2014 and May 2015 when Volkswagen issued more than $13 billion in bonds. It is said that Volkswagen pursued the funding through misstatements surrounding vehicle quality and regulatory compliance, despite high-level executives being aware that more than 500,000 vehicles sold in the U.S. did not comply with emission standards.

In 2015, Volkswagen was found to be willfully equipping a large number of its diesel-powered vehicles with emissions defeating devices that polluted well over the legal limit when not being actively tested for compliance. The automaker eventually admitted to equipping and selling more than 11 million vehicles worldwide with the defeat devices and became the poster child of the scandal affectionately coined dieselgate.

The SEC looks for Volkswagen to repay any of its ill-gotten gains, complete with interest and civil penalties. Additionally, it asks for Winterkorn to be barred from acting as a director or officer of any publicly traded company.

Since the scandal, Volkswagen has shifted its approach away from building a better diesel platform to instead developing electric cars. In all, the automotive giant has announced an investment of more than $50 billion into electrification companywide, a number which nearly doubles its $30 billion in dieselgate-related fines and penalties.